Custodian accounts. Platforms which offer custodian SDIRA accounts hold your assets in a very believe in in your case inside the IRA structure, managing most of the paperwork and compliance required through the IRS. These accounts have to have that you're employed having an account expert to purchase and promote assets.

Personal investments involve a significant diploma of chance and, therefore, needs to be carried out only by potential buyers capable of assessing and bearing the hazards these an investment signifies.

Alto can make it easier to speculate in alternative assets by partnering with top rated investment platforms as an alternative to seeking to develop everything by themselves.

Higher investment options suggests you can diversify your portfolio past shares, bonds, and mutual resources and hedge your portfolio against industry fluctuations and volatility.

Custodian-Controlled SDIRA: A custodian handles transactions and makes sure compliance, but approvals may perhaps slow down investments.

Our purpose is to maintain a balanced best-of listing featuring leading-scoring brokerages from reliable manufacturers. Purchasing inside of lists is motivated by advertiser payment, like featured placements at the top of the specified record, but our solution suggestions are Never ever affected by advertisers. Find out more regarding how Motley Idiot Funds costs brokerage accounts.

Purchasing alternative assets can offer superior returns but could also include improved current market pitfalls and lessen liquidity. Property, private equity, and precious metals are prolonged-time period investments which will acquire time to convert into cash.

Be in command of the way you develop your retirement portfolio by utilizing your specialized understanding and interests to speculate in assets that suit along with your values. Got know-how in housing or private fairness? Utilize it to help your retirement planning.

At Alto, you'll be able to accessibility two hundred+ cryptocurrencies through their direct integration with copyright. And regardless of whether you’re an Energetic trader or perhaps a acquire-and-maintain Trader, Each and every transaction only bears a 1% fee. But Probably the better part is all the charges you received’t fork out.

A Self-Directed IRA presents highly effective investment opportunities further than traditional shares and bonds. Irrespective of whether you might be keen on precious metals, real estate property, or cryptocurrencies, picking out the suitable SDIRA service provider is essential for maximizing your retirement savings.

You'll want to only put money into assets you have a strong idea of and possess researched beforehand.

The Roth IRA is a novel and effective tool for retirement savings. That’s mainly Bonuses because such a unique retirement account includes tax-free withdrawals, a massive edge that offers you much more choices for handling taxes in the retirement strategy.

Fraud: The Securities and Exchange Fee issued an investor notify regarding the threats of self-directed IRAs, which includes fraud. The SEC claims get more to pay attention to pretend custodians providing to just take your cash, together with fraudulent investments becoming available by respectable custodians.

You could potentially also open a Roth IRA at a financial institution, Whilst you’ll be limited to holding certificates of deposit (CDs), which will not give the kinds of returns necessary to build your retirement nest egg in excess of the long run.

Katie Holmes Then & Now!

Katie Holmes Then & Now! Barbi Benton Then & Now!

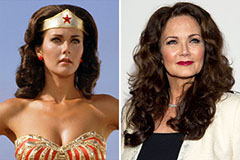

Barbi Benton Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now! Lucy Lawless Then & Now!

Lucy Lawless Then & Now! Tina Louise Then & Now!

Tina Louise Then & Now!